Insurance Agent : Underwriter

6-in-1 Special Bundle | Free 6 PDF Certificates Worth £24 | CPD Accredited | Lifetime Access | Expert Support —Enrol Now

Compliance Central

Summary

- Certificate of completion - Free

- Certificate of completion - £9.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

► Enrol TODAY to Claim a BIGGER Saving ◄

< 6 CPD Accredited Courses Ahead >

Up to 94% Off for the Insurance Agent course package! Enrol before the offer ends!

Are you looking to enhance your Insurance Agent : Underwriter skills? If yes, then you have come to the right place. Our comprehensive courses on Insurance Agent : Underwriter will assist you in producing the best possible outcome by learning the Insurance Agent : Underwriter skills.

This Insurance Agent : Underwriter Bundle Includes

Get 6 CPD Accredited Courses for only £41 with 6 Free PDF Certificates worth £24! Offer Valid for a Limited Time!! So Hurry Up and Enrol Now!!!

- Course 01: Insurance Agent Training

- Course 02: Financial Analysis

- Course 03: Financial Crime Manager

- Course 04: Compliance and Risk Management

- Course 05: Anti-Money Laundering (AML) Training

- Course 06: Contracts Law UK 2021

So, enrol in our Insurance Agent : Underwriter bundle now!

Other Benefits

- Lifetime Access to All Learning Resources

- An Interactive, Online Course

- A Product Created By Experts In The Field

- Self-Paced Instruction And Laptop, Tablet, And Smartphone Compatibility

- 24/7 Learning Support

- Free Certificate After Completion

CPD

Course media

Description

Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts.

So, enrol and excel in your career with Compliance Central.

★★ Curriculum Breakdown of Insurance Agent Training ★★

- Module 01: An Overview of the UK Insurance Industry

- Module 02: Principles of Insurance

- Module 03: Types of Insurance

- Module 04: Career in the Insurance Industry

- Module 05: Skills of an Insurance Agent

- Module 06: Business Insurance

- Module 07: Risk Management in Insurance

- Module 08: Underwriting Process

- Module 09: Insurance Claims Handling Process

- Module 10: Fraud Finding in Insurance

- Module 11: Code of Ethics and Conduct

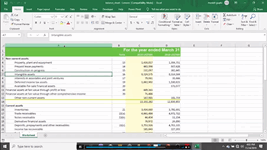

★★ Curriculum Breakdown of Financial Analysis ★★

- Section 01: Introduction

- Section 02: Profitability

- Section 03: Return Ratio

- Section 04: Liqudity Ratio

- Section 05: Operational Analysis

- Section 06: Detecting Manipulation

★★ Curriculum Breakdown of Financial Crime Manager ★★

- Module 01: Introduction to Financial Investigation

- Module 02: Characteristics of Financial Crimes

- Module 03: Categories of Financial Crimes

- Module 04: Responsibility of the Money Laundering Reporting Officer

- Module 05: Risk-based Approach

- Module 06: Customer Due Diligence

- Module 07: Record Keeping

- Module 08: Suspicious Conduct and Transactions

- Module 09: Laws against Financial Fraud

- Module 10: Property Law

- Module 11: The Mortgage Law

★★ Curriculum Breakdown of Compliance and Risk Management ★★

- Module 01: Introduction to Compliance

- Module 02: Five basic elements of compliance

- Module 03: Compliance Management System (CMS)

- Module 04: Compliance Audit

- Module 05: Compliance and Ethics

- Module 06: Risk and Types of Risk

- Module 07: Introduction to Risk Management

- Module 08: Risk Management Process

★★ Curriculum Breakdown of Anti-Money Laundering (AML) Training ★★

- Module 01: Introduction to Money Laundering

- Module 02: Proceeds of Crime Act 2002

- Module 03: Development of Anti-Money Laundering Regulation

- Module 04: Responsibility of the Money Laundering Reporting Officer

- Module 05: Risk-based Approach

- Module 06: Customer Due Diligence

- Module 07: Record Keeping

- Module 08: Suspicious Conduct and Transactions

- Module 09: Awareness and Training

★★ Curriculum Breakdown of Contracts Law UK 2021 ★★

- Module 01: Introduction to UK Laws

- Module 02: Ministry of Justice

- Module 03: Agreements and Contractual Intention

- Module 04: Considerations and Capacities of Contact Laws

- Module 05: Terms within a Contract

- Module 06: Misinterpretations and Mistakes

- Module 07: Consumer Protection

- Module 08: Privity of Contract

- Module 09: Insurance Contract Laws

- Module 10: Contracts for Employees

- Module 11: Considerations in International Trade Contracts

- Module 12: Laws and Regulations for International Trade

- Module 13: Remedies for Any Contract Breach

Who is this course for?

Anyone from any background can enrol in this Insurance Agent : Underwriter bundle.

Requirements

To enrol in this Insurance Agent : Underwriter, all you need is a basic understanding of the English Language and an internet connection.

Career path

After completing this course, you can explore trendy and in-demand jobs related to Insurance Agent : Underwriter.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

6 CPD Accredited PDF Certificate for Free

Certificate of completion

Hard copy certificate - £9.99

CPD accredited hard copy certificates are available for £9.99 each

Delivery Charge for Each Hard Copy Certificates:

Inside the UK: £3.99

Outside of the UK: £9.99

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.